Whether you’re an employer or an employee, it’s beneficial to have an understanding of what group benefits are, how they work, and what the numerous benefits are associated with them (including cost-savings).

Since Westland MyGroup has helped over 150 organizations find optional group insurance packages at deep discounts, we know a thing or two about this stuff. That’s why we’ve put together this comprehensive guide to help you understand how group insurance works, straight from our brokerage.

Let’s begin.

- What is a group policy insurance

- The difference between individual insurance and group insurance

- How does group insurance work?

- Eligibility requirements for group insurance

- Benefits of group insurance for employers

- Benefits of group insurance for employees

- How to enroll in a group insurance plan

- Pricing & savings

What is a group policy insurance?

A group insurance plan (or group insurance for short) is a type of insurance policy that provides coverage to a group of people. Groups of people who commonly use group insurance include employees at a company, students at a post secondary institute, or members of a society or professional association. Types of group insurance include health, home, auto, travel, personal accident insurance, and more.

The difference between individual insurance and group insurance

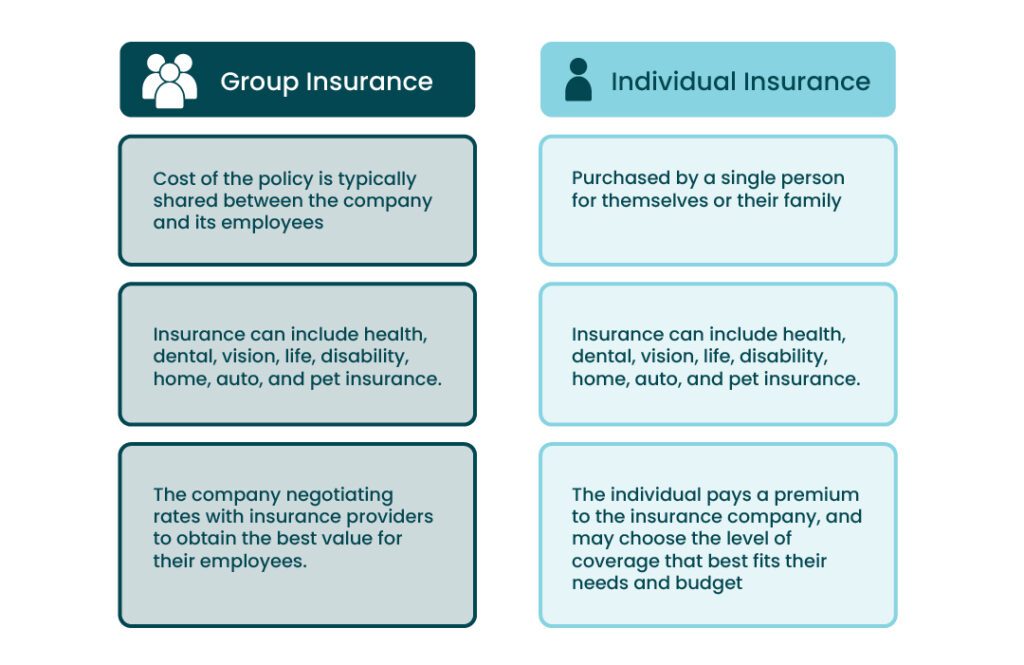

Group insurance is different from individual insurance in that individual insurance is purchased by a single person for themselves or their family. Like group insurance, this can include health, dental, vision, life, disability, home, auto, and pet insurance.

With individual insurance, the individual pays a premium to the insurance company to obtain coverage and may choose the level of coverage that best fits their needs and budget. The cost of individual insurance can vary based on type of insurance and factors such as age, health status, and the level of coverage selected.

With group insurance, the cost of the policy is typically shared between the company and its employees, with the company negotiating rates with insurance providers to obtain the best value for their employees.

Westland MyGroup takes things a step further. When an organization enrolls for group insurance with MyGroup, individuals within the organization get to enjoy group discounts on home, tenant, travel, and pet insurance at no additional cost to the organization. Partnering with over 30 insurance providers in Canada and overseas, Westland MyGroup is able to transfer savings of up to 15% on insurance plans to individuals.

How does group insurance work?

Group insurance works by using the buying power of the group to negotiate additional discounts for individual group members. Having more members paying into the insurance plan is kind of like buying in bulk, everyone gets a discount because of the volume of people paying into the program.

There are several different types of group insurance, below we’ll cover how group home and auto insurance works as well as group health and dental insurance.

How does group home and auto work?

At a high level, group home and auto insurance works as follows:

An organization contacts a broker like Westland Mygroup and completes an application. The information collected during the application process includes details about the company, location, number of employees, and more.

This preliminary information is used to determine the size of the discount available to the employee group from the insurer. The company then gets a quote and once the group plan is in place, members enroll themselves and can apply for home and auto insurance at a discounted rate. (Employee participation in the program is strictly voluntary and the premiums are paid 100% by the employee, not the employer.)

How does group health and dental insurance work?

At a high level group health and dental insurance works as follows:

An organization contacts an insurance broker and completes an application. The information collected includes basic information about the company (including the number of employees). Like group home and auto, this preliminary information is used to determine the size of the discount available to the group from the insurer. Terms and conditions are then negotiated between the company and the insurance company.

The terms and conditions that are negotiated often include:

- How many members are needed as a minimum for the group plan to be active.

- The types of services that will be covered in the plan.

- The premiums paid by the plan holder(s).

- The deductibles paid by group members (e.g. a company and employees) when making a claim.

- The dollar amount covered for each service (e.g. up to $500 per year).

- The pricing and claim structure (including the total cost of the group insurance plan). The cost is primarily paid for by the organization, while members often contribute to some of the cost as well.

Organizations then determine how to structure their internal pricing system—specifically, how much they’ll pay each month to maintain coverage. In a business, this is usually taken off of each employee’s pay cheque per pay period.

Once the group plan is in place and members enroll, they’re able to receive services from providers within the insurance provider’s network and submit claims to the group insurance provider where a portion of the cost is reimbursed to them.

The insurance provider then bills the organization for the cost of the premiums based on the number of group members enrolled in the plan and the number of claims made.

Eligibility requirements for group insurance

For employers, they must have a minimum number of employees to be eligible for group insurance. The number will vary depending on the insurance provider and type of coverage. The employer may also require a certain percentage of eligible employees to be part of the group insurance plan to maintain coverage.

For employees, they must be full-time employees at the company and typically have to wait 30 to 90 days after their start date for their coverage to begin.

Benefits of group insurance for employers

Here are the top benefits for companies that offer group insurance to their employees.

Attract and retain employees

According to Glassdoor, 57% of people report benefits as one of the most important considerations before accepting a job. Offering a group insurance plan to employees gives any company a strong competitive advantage in the job market. Insurance coverage options for employees and their family members makes a company more attractive to potential employees and will help any company attract some of the best talent in their industry.

Tax benefits

Premiums for group insurance plans are typically tax-deductible for employers. This adds a secondary bonus of offsetting the cost of the coverage itself.

Reduces absenteeism

When employees have access to the group insurance services, they take fewer sick days, are able to recover quicker when they do become ill, and overall absenteeism is decreased company-wide. Group insurance plans also encourage employees to seek preventive care, leading to a healthier workforce and lower healthcare costs over time. This reduction in absenteeism also has a positive impact on productivity and performance.

Add-on options

With group coverage, employers are eligible to offer insurance add-ons to their basic plan. Westland MyGroup, for example, offers extra coverage and discounts on additional types of insurance including auto, home, tenant, estate, travel, motorcycle, and pet.

Businesses can even take out additional forms of insurance through Westland MyGroup like anti-spam coverage, business interruption, business liability, commercial property, commercial vehicle, cyber liability, directors & officers, errors & omissions, and equipment breakdown.

Zero additional cost

All these benefits come at no extra cost to the employer, making it a no-risk benefit for organizations.

View MyGroup coverage options for individuals and businesses

Benefits of group insurance for employees

Here are the top benefits for employees who receive group insurance to their employers.

More affordable than individual insurance

Group plans are more affordable per person because the cost of the insurance policy is spread across group members rather than falling onto the shoulders of a single individual—often for the same or comparable coverage.

Increased job satisfaction

Providing group insurance coverage makes employees feel valued and appreciated by their employers. This can lead to higher job satisfaction among the team and an overall boost in morale.

Better financial protection

Paying for an unexpected medical bill out of pocket can be a huge financial burden on some. When employers take out group insurance plans, they provide employees with better financial protection against unexpected expenses, which helps them avoid financial hardship and save on out-of-pocket costs.

Custom solutions

With brokers like Westland MyGroup, individuals can create bespoke home and auto insurance plans to suit their needs and budget.

How to enroll in a group insurance plan

For group home and auto

For employers, you first need to fill out a group insurance program request with the group insurance company you choose, like Westland MyGroup. Your broker will be able to discuss your organization’s needs and answer any questions you might have about group insurance plans. You’ll then provide plan information to your employees and have them apply by submitting enrollment forms to the insurance provider.

For employees, the process is simple. For most insurance providers, you can simply visit their site, type in your company name, and you’ll be directed to a specific group benefits landing page where you’ll request a quote. A Westland MyGroup insurance advisor will contact you to collect more detail over the phone and finalize the setup.

Call out: Not tech savvy? Give us a call at 1-844-999-7687 and Westland MyGroup’s will be happy to help you get a quote over the phone!

For group health and dental

For employers, you first need to select a group health insurance company you want to go with and fill out an application. You’ll then determine employee eligibility and develop a contribution strategy. Your broker will be able to discuss your organization’s needs and answer any questions you might have about your insurance plan. You’ll then provide plan information to employees where they can opt in or out of the coverage. If they opt in, the fill out an application form that you send to the insurance company.

For employees, your employer sends you information on the plan. If you opt to receive coverage, you fill out an enrollment form with some basic personal information as well as your banking information for reimbursement. You then send the form back to your employer (or human resources manager) and they send it to the provider.

Pricing & savings

The average annual premium for a group insurance plan ranges between $1,500 and $4,000 per employee (about 15% of payroll for a smaller business or up to 30% of payroll for large companies). The premium payments are shared between employer and employees and optimized in a way that minimizes the tax impact for employees.

Employees at large companies can save up to 15% on home and auto insurance when they opt into Westland’s MyGroup insurance program. Employers will have zero start up and ongoing costs— a win-win on both sides!

Employee coverage for every need

Whichever group insurance plan you choose, Westland MyGroup offers discounted value-added benefits to offer additional coverage to your team at no additional cost to your organization. This includes coverage like home, auto, tenants, pet, travel, and motorcycle insurance.

For businesses, we also offer additional insurance such as anti-spam coverage, business interruption, business liability, commercial property, commercial vehicle, cyber liability, and equipment breakdown insurance.

Get started on setting up a group benefits plan that works for your organization. Get a quote today from MyGroup.