Group insurance benefits provide coverage to members of an organization at a discounted rate. The specific benefits of a group insurance plan depend on what type of coverage the plan offers. Group insurance benefits packages can include health coverage and/or other coverage like home, tenant, auto, and pet insurance.

Westland MyGroup has helped over 150 partner companies and associations across Canada access exclusive discounted rates on home and auto insurance.

In today’s competitive job market, these are the types of things potential employees are looking for and evaluating when choosing which company to work for. And all this is at no monetary cost to your business! Without group insurance benefits for your organization, you could not only lose money due to lost productivity from sick or injured team members, but lose out on talented individuals overlooking your company because it doesn’t offer group insurance benefits as a perk.

Happy and healthy employees make productive team members. When your company or organization can provide essential and optional insurance for your employees or group members, you’re showing them that you care about their well-being.

In this article, we’ll define and discuss the advantages of group insurance benefits for employers and employees and outline optional insurance benefits that won’t cost employers a dime.

Main Takeaways

What is a group insurance policy?

A group insurance policy provides insurance coverage for your employees or organization members, often at a discounted rate. Many employers provide their staff with health benefits as part of their compensation package, but organizations can also register for supplemental group insurance plans to extend their coverage and comp plan to include home and auto insurance, for example.

When an employer has a competitive group insurance program, employees can get access to insurance coverages such as health, home, auto, tenant, estate management, and pet insurance. This insurance can be used for employees and their dependent children and other family members in their household.

Group insurance plans can be created for any group of people. Most commonly, these are used by businesses for their employees, but they can also be adopted by professional associations, such as boards of trade, educational institutions, and niche professional industry associations.

What is group buying power?

A group insurance plan is affordable through the power of group buying (or collective buying). Group buying allows your insurer to offer you a lower rate per person because they’re expecting to have a minimum number of buyers. It’s like getting a discount on office supplies because you buy your pens in bulk, rather than individually.

When you register for group insurance coverage for your employees, you’re telling your insurer that you’re sending them a bunch of new customers and asking for a discount on their premiums in exchange.

What are the advantages of a group plan?

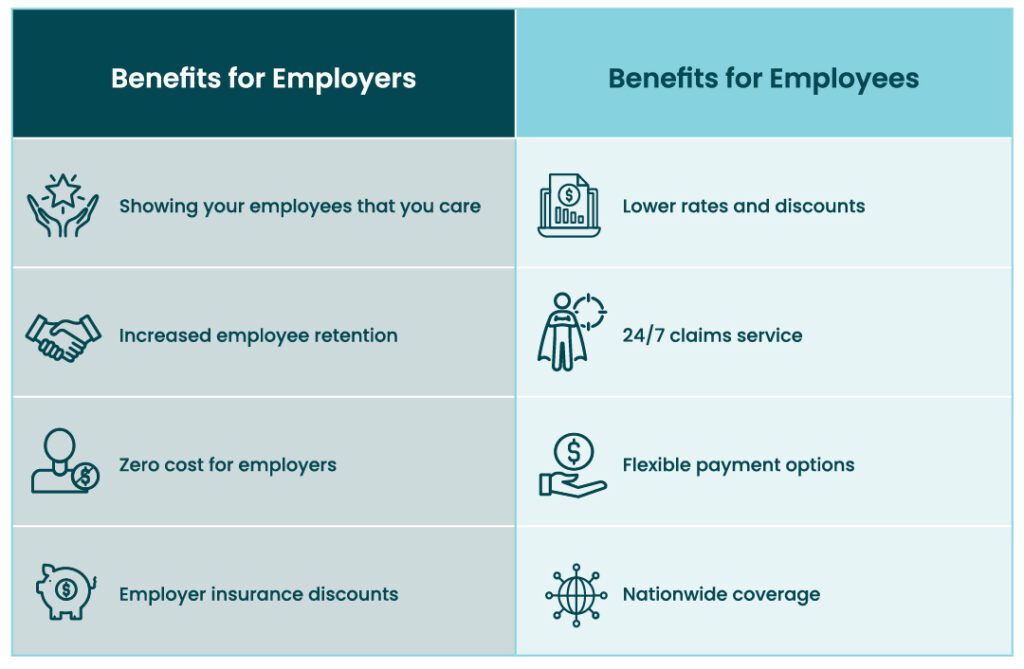

There are many advantages of group insurance coverage to both the employer and their employees:

Group insurance plan benefits for employers

The most significant benefit of group insurance plans for employers is showing your employees that you care and want to help them keep more money in their pockets. This separates your company from your competition. If a potential candidate were deciding between you and your competitor, a comprehensive benefits package might just be what puts you over the edge.

Other employer benefits of group insurance plans include:

- Increased employee retention: In today’s highly competitive job market, benefits packages may be a key differentiating factor. Access to optional benefits or benefit top-ups is a crucial selling point for individuals looking for jobs.

- Zero cost for employers: When you add an optional group health coverage plan that employees choose to purchase, you don’t need to pay into more expensive employee benefits packages that many employees may not use. This puts the control in the hands of your members and saves you money.

- Employer insurance discounts: With a group health insurance benefits plan, your company may qualify for discounts on its own insurance policies. Savings are typically around 15%.

With Westland MyGroup, you can offer your members supplemental, individual home and auto insurance with fully customized plans to fit each person’s needs and budget.

When you work with MyGroup, you enjoy the added benefits of:

- Exclusive discounts

- Hassle-free implementation

- Customizable options

- Exceptional service

- Outstanding value

- Progress & performance reporting

- Access to multiple insurers

Learn more about MyGroup’s benefits for groups and employers

Group insurance plan benefits for employees

Providing group insurance isn’t just beneficial for employers—employees enjoy many benefits too, including the choice to add coverage to any type of group benefits plan. When your employees or members are part of a basic or supplemental group benefits plan, they benefit from:

- Lower rates and discounts: With group home and auto insurance plans, your insurer can offer lower rates per person to group members. Individuals approaching the insurance company directly can’t get the same discounts or preferred rates as they don’t have a big enough collective buying power. For employer-paid benefits, you also get a cheaper rate compared to if your members bought insurance individually.

Westland MyGroup members also enjoy the following exclusive benefits:

- 24/7 claims service: With group insurance plans, your team members can submit a claim 24/7 online directly with the insurer. This helps them get their claim approved and money back into their pocket quickly. Some plans offer direct billing so your employees never have to pay out of pocket for certain services (or only pay a portion out of pocket).

- Flexible payment options: Brokers like Westland MyGroup offer flexible payment plans, so you can remain confident in your coverage.

- Nationwide coverage: As long as you choose an insurance broker with coverage across Canada, you’ll enjoy the benefits of coast to coast coverage.

Learn more about group benefits for employees and members

How much does group insurance cost?

The cost of group health insurance in Canada ranges between $1500-$4000 per employee, depending on the type of coverage offered. However, with group home and auto insurance, there is no extra cost to the employer. They simply enroll their members, and pass on savings of up to 15% on coverage to members. It’s a win-win.

What are the advantages of group home and auto insurance plans through Westland MyGroup?

When you choose Westland MyGroup for your group’s optional insurance plans you get a value-added benefit to provide to your members at no cost to your organization.

MyGroup offers:

- Group insurance plans for home insurance (including condos, renters insurance, seasonal properties and rental properties)

- Professional liability, commercial general liability and business property coverages for offices, clinics, service and other retail establishments.

- Travel insurance and pet insurance for individuals and families.

In addition to the employer and individual benefits we mentioned above, when you choose Westland MyGroup for group insurance plans, you also benefit from the following:

- 100% insurability for your team through Westland MyGroup’s extensive relationships with insurers in multiple markets.

- No start-up, ongoing, or promotional costs; it includes hassle-free implementation and no additional management.

- A dedicated business development manager to provide you with the personalized support you need and provide progress reports to gauge the success of your benefits program.

- Exceptional customer service and easy-to-understand, flexible coverage for your team, including travel, pet, and group life insurance.

View all MyGroup coverage options for organizations and individuals

Bespoke group insurance tailored to your organization’s needs

Westland MyGroup includes options for digital and phone consultations and policy purchasing. We’ve noticed that most online-only insurance companies often cause issues for customers as customers don’t usually choose the proper limits or type of coverage.

With Westland MyGroup, you can start your quote online and have it reviewed by a real live broker to ensure you have the limits and coverage you actually need. Then you get support online or in-person as you need it.

Group insurance coverage protects your employees, members, their families and your business. You get a low-cost solution to protect your employee’s health and well-being so they can be more productive for your business.