Group insurance can cost as little as under $50 per year and as much as hundreds per month, depending on your coverage types and group discounts. But choosing the wrong policy can cost you a lot more in the long run.

The right insurance policy can help ease anxiety in your day-to-day life. However, with the high cost of insurance, it can be hard to select a plan with thorough yet affordable coverage. And if you’re trying to select group insurance benefits for your business, you’re probably facing a similar struggle.

Established in 1980, Westland Insurance has witnessed insurance costs grow over the decades. We created Westland MyGroup to provide discounted rates on home and auto insurance to organizations across Canada. Our group insurance plans have $0 cost for our members.

Before you commit to a plan, you’ll want to know the answer to one important question: how much does group insurance cost?

Here’s what we’ll cover in this article:

- What is the difference between group insurance and individual insurance?

- Group insurance plan

- Individual insurance plan

- How much does each insurance type cost?

- Group insurance costs for employers

- Cost of premiums for members

- Estimated insurance premiums for different plan types

- What factors affect the cost of insurance?

- What to look for when choosing group insurance

- Average deductibles in Canada

- What kinds of group insurance does Westland MyGroup offer?

- Who pays the premium on a group policy?

- Choose the right policy for you

What is the difference between group insurance and individual insurance?

If you’re looking to purchase insurance, you may be unsure whether you want to purchase that insurance through your employer (group insurance) or find a plan on your own (individual insurance). Here’s what you need to know about the differences in insurance cost for the two options.

Group insurance plan

With a group plan, an employer offers their employees a selection of coverage plans—most commonly, health insurance. The employer will pay for some or all of their employees’ monthly health coverage premium and may also be able to answer questions about the plans directly. If an employee pays part of it, that amount will be deducted from their paycheck.

The best part is that group insurance isn’t limited to just health insurance. Employers can also offer group home insurance and group auto insurance to make their total compensation and benefits package even more impactful.

For example, Westland MyGroup offers optional home, auto, pet, and travel insurance for employees as a value-added benefit at no additional cost to the organization.

Get started with setting your organization up with a no-risk group benefits plan. View coverage for individuals and businesses.

Individual insurance plan

With individual insurance, you may have a wider selection of plans to choose from (every plan that exists), but you almost always end up paying more.

If you go this route, you’ll need to spend quite a bit of time shopping around for the right plan for family coverage. You’ll then purchase the insurance coverage directly from the insurance company.

Since employers aren’t involved in individual plans, you’ll need to navigate questions and claims on your own, without the clout and influence of a larger group.

How much does each insurance type cost?

Group insurance plans are generally less expensive than individual insurance, thanks to group buying power. But group insurance has different costs for employers and employees.

Here’s a quick breakdown:

Group insurance costs for employers

Because there are so many types of group insurance benefits, it can be challenging to estimate how much it costs employers.

Most companies pay between 15% and 30% of their total payroll toward employee insurance for covered workers. On a per-employee basis, most businesses spend $8,330 annually per employee to provide benefits.

Since individual insurance is purchased outside of work, employers don’t pay anything toward individual plans.

With Westland MyGroup, employers incur $0 in startup, promotional, or ongoing costs, making it a no-risk benefit to your organization. Request a quote to get started.

Cost of premiums for members

With group insurance, employees and employers typically share the cost of premiums. Most employers will cover between 80% and 100% of the cost, which may vary based on whether you choose single coverage or family coverage.

Based on the averages in the table below, employees may pay as much as $1,600 per year in insurance premiums, while families may pay up to $4,000. However, the employee premium cost is often less because many employers cover more than 80%.

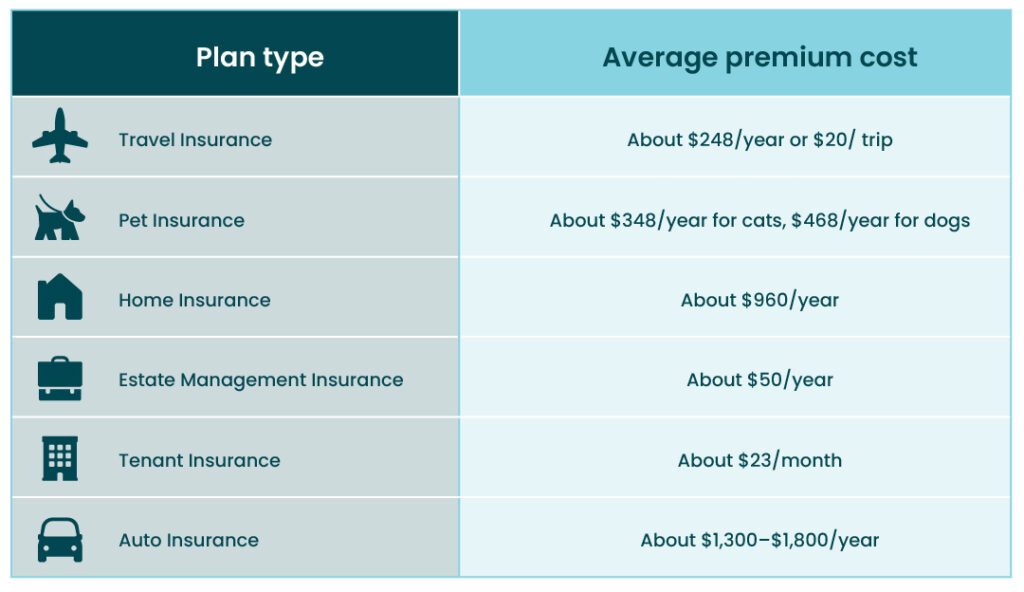

Other types of add-on insurance tend to be much less expensive. Here’s a general guideline to the average premium the employee pays:

Estimated insurance premiums for different plan types

Keep in mind that these are just estimated premiums, and they can vary depending on your circumstances. For example, if you’re a high-risk driver or you purchase full-coverage auto insurance, your premium will likely be higher than the one shown. Likewise, if you’re going on a luxurious, expensive trip, travel insurance will cost a bit more.

These average costs can be reduced by up to 15% when you choose group insurance over individual insurance. But there are other factors that can influence your baseline costs of insurance coverage:

What factors affect the cost of insurance?

The cost of insurance can vary greatly. But generally speaking, group insurance plans cost less than individual plans, thanks to a process known as “risk pooling.” In risk pooling, the risk assumed by the insurance company is spread out over a large group, so the insurance company takes on less liability than it would with individual insurance. Consequently, premiums will be lower. Sometimes, larger groups of insured employees will result in your premium being further reduced.

Individual insurance plans can have quite a bit of variation when it comes to cost. Thanks to several variables, insurance premiums can vary widely between members, even for the same or similar plans. Here are some of the main factors that can influence the cost of your individual plan:

- Your income

- The size of your employer

- The type of community you live in

- The type of plan you have

- Your age

- Your selected plan’s deductible

- Whether you use tobacco

Essentially, these factors boil down to two things: how much risk the insurance provider thinks you present and the type of plan you select (or your employer offers).

What to look for when choosing group insurance

Selecting insurance policies can be challenging for employers and employees alike, as there’s often a dizzying number of variables to consider. Here are a few key things to look for.

Group plan type

The first step in getting group insurance coverage is determining which types of insurance you need and the coverage level you’re comfortable with.

Here are the most common types of group insurance and the coverage you can expect from each:

- Health: These are usually workplace benefits that offer coverage for things provincial health plans may not cover, including prescription drugs, vision, dental, and paramedical services.

- Home: Typically covers wind damage, theft, and fire damage; some policies cover more types of damage (homeowners only)

- Tenant: Covers your belongings if they are stolen or damaged and covers medical costs if someone is injured in your home (tenants only)

- Auto: All auto insurance policies in Canada must cover third-party liability, uninsured auto coverage, and accident benefits, but you can obtain collision and comprehensive coverage as well*

- Pet: Usually covers medical costs if your pet becomes sick or injured

- Travel: Typically covers lost luggage, illness and injury, and cancelled trips

As you’ve likely guessed, the type of each plan you get also has a major impact on cost. More comprehensive insurance policies, like all perils coverage for cars (covers all types of damage), are more expensive than policies with less coverage.

Deductible

The deductible is what you pay out-of-pocket before sharing costs with your plan, so choosing group insurance with a relatively low deductible can limit how much you need to pay.

When you have a low deductible, you’ll likely pay less out-of-pocket if you make a claim. However, because of that, low-deductible policies typically have higher monthly premiums. With a high-deductible policy, you pay more in the event of a claim, so your premiums will be lower.

Choosing between high-deductible plans and low-deductible plans can feel like a bit of a gamble. After all, if you never file a claim, you might not feel that high monthly premiums are worth it. But, if you do find yourself needing to use your insurance and you have a very low deductible, you might find the out-of-pocket costs to be unaffordable.

Average deductibles in Canada

For auto insurance, most drivers in Canada have a deductible around $500, though deductibles will usually range somewhere between $300 and $1,000. Pet insurance will usually have a deductible of about $300.

Home insurance typically has a higher deductible — $1,000 is about average, but most policies have a deductible between $500 and $2,000. Tenant insurance is a bit lower, with deductibles typically ranging from $500–$1,000. Travel insurance deductibles have a huge amount of variation, as you can find zero-deductible policies all the way up to those with a deductible of $1,000 or more.

What does this mean for you?

Let’s say you’ve been in an accident and your car needs $3,000 in repair. If your policy has a $500 deductible, you pay $500 and the insurance company pays $2,500 toward car repairs.

On the other hand, if you have a $1,500 deductible, you will need to cover $1,500 of the repair costs. The insurance company would cover the remaining $1,500.

Before deciding on what deductible you’re comfortable with, take a careful look at your risk tolerance and your likelihood of filing a claim. Only you can decide what level of risk you’re comfortable with. The good news is that with the savings you get with a group policy, you can get a quality policy for less!

What the plan covers

It’s important to read the fine print when selecting a group insurance plan. Plans of the same type are not equal. For example, some auto policies only cover liability, and they won’t pay for damage caused to your car. Many home insurance policies will cover wind damage but not damage from earthquakes.

So, before you commit to a plan, make sure you read all the paperwork, especially the fine print. Double-check to see that your plan has all your must-haves before you buy!

To get a sense of the types of plans we offer, check out MyGroup’s benefits for groups. When you work with Westland Mygroup, you don’t need to be an insurance expert to ensure you’re getting the best coverage for your needs. If you have any questions, one of our knowledgeable brokers can work with you to help you find the perfect plan that covers everything you need.

What kinds of group insurance does Westland MyGroup offer?

Because group plans are almost always less expensive than individual plans, Westland MyGroup offers group home insurance, group auto insurance, and other types of supplementary insurance at a deep discount.

Since we have access to multiple markets, we can shop around for the best deals for you. As a result, our supplementary plans are 15% less expensive on average than regular rates.

We offer a range of group insurance products, including:

- Auto insurance

- Home insurance

- Travel insurance

- Pet insurance

For offices, clinics, and other retail establishments, we offer business insurance programs, including:

- Professional liability

- Business property coverage

- Commercial general liability

- And more, with bespoke plans available according to your industry

If you’re an employee, you’ll benefit from more affordable premiums thanks to our group discounts. If you’re an employer, you’ll save money while offering standout benefits to entice new employees.

With these kinds of savings, employees are more likely to want to stay with your company.

With many group policies, both the employer and employee pay toward the monthly premium. However, the employer pays the majority of the premium in nearly every case. This is another reason why opting for a group policy can be wise if your primary goal is to save money.

With optional benefits, like those provided by Westland Mygroup, members take advantage of risk pooling and group buying power to get deep discounts on insurance costs. Because employers incur $0 in startup, promotional, or ongoing costs, it’s a win-win decision.

Choose the right policy for you

Whether you’re an employer interested in offering a group insurance program or an individual trying to pick the best plan for yourself and your family, Westland MyGroup can lend a hand.

At Westland MyGroup, we offer coast-to-coast coverage without increased premiums. We have more than 40 years of experience helping people find the right group and individual plans. Contact us today to get a quote or request additional information.

*Auto group plans are not available in British Columbia, Saskatchewan or Manitoba